If you are injured in a traffic accident in Southern California, take these steps: Call for medical assistance, call the police, and after you have been treated for your injuries, call a Pasadena personal injury lawyer to discuss your legal options and your right to compensation.

It is easy to find advice about what you should do after a traffic accident happens, but it is just as important to know what steps you should take before a traffic accident. How can you be prepared in advance for a traffic crash? What measures can you take right now to protect yourself?

If you’ll keep reading this brief discussion about how to be prepared for an accident, you’ll find the answers to these questions. You will also learn what a Pasadena car accident attorney will do for you if, despite your best efforts, you are injured in a traffic crash in Southern California.

What Automobile Insurance Does California Legally Require?

Preparing in advance for a traffic accident begins with a personal insurance check-up. You should review both your automobile insurance policy and your homeowner’s policy to determine exactly how much and what kind of insurance coverage is currently protecting you.

Liability insurance is the insurance that protects you if another party brings a lawsuit against you. The law in California requires every driver in this state to carry the following minimum automobile liability insurance coverage:

- $15,000 of liability coverage for one person’s injury or death

- $30,000 of liability coverage for multiple injuries and/or deaths in the same accident

- $5,000 of liability coverage for property damage

California lawmakers have established these minimum coverage amounts, but drivers in this state can and should carry more coverage – especially uninsured/underinsured motorist coverage.

How Does Uninsured/Underinsured Motorist Coverage Work?

If you meet the minimum requirement and you’ve even purchased additional liability coverage, you are protected if someone sues you over a traffic accident. But what if you are the person who is injured and the other driver has insufficient liability coverage – or has no auto insurance at all?

Along with liability coverage, drivers in California should also carry uninsured and underinsured motorist coverage. It is not legally required, but uninsured and underinsured motorist coverage protects you if you are injured in a collision and the at-fault driver cannot cover your damages.

Penalties for driving without auto insurance in this state are minimal; the maximum fine for a second offense is only $500. About 14 percent of California drivers – one in seven – are entirely uninsured, and thousands of California motorists have inadequate auto insurance coverage.

A driver with no insurance usually has no money, so suing that driver – even if you win – would be futile, but if you carry uninsured/underinsured motorist coverage, and if a driver who has no auto insurance injures you, you may file a claim against your own policy to cover your damages.

What Auto Insurance Coverage Do You Genuinely Need?

Speaking honestly, the required minimum auto insurance coverage amounts in California are woefully low. If you are severely injured, $15,000 may not be enough to cover your hospital bills and related medical expenses, and those expenses will do nothing but increase in the years ahead.

Realistically speaking, a driver in California should carry at least $100,000 of liability coverage and $100,000 of uninsured/underinsured motorist coverage. If you are able to afford $250,000 or $500,000 of coverage, purchase it. Raising your coverage limits is surprisingly inexpensive.

What Are “Umbrella’ Policies and “Excess” Policies?

You should consider purchasing a personal liability umbrella policy which provides coverage beyond uninsured/underinsured motorist coverage. Personal umbrella insurance is liability insurance that goes beyond your other policies to cover losses not covered by those policies.

You may also consider purchasing an “excess” or “secondary” insurance policy which covers a claim after the primary policy’s coverage limit has been exhausted. How can you learn more about the auto insurance coverage you need and the policies that are available?

The California Department of Insurance provides an easy-to-read, online Automobile Insurance Information Guide that offers comprehensive and practical information to motorists in California regarding the automobile insurance coverage they should carry.

What Are the Penalties for Driving Without Auto Insurance?

Driving without automobile insurance is an infraction in California that may be penalized upon conviction with a fine of $100 to $200 and other state assessments and legal fees.

However, if a California motorist is cited a second time for driving without auto insurance within three years of the first infraction, that driver may be fined up to $500. The court can also order the driver’s vehicle impounded.

The penalties for driving without insurance may not seem harsh, but if you are injured or if you cause an injury in an accident, and you do not have auto insurance, the consequences are serious. The court could suspend your license, and you could be sued for injuries and property damages.

When Should You Contact an Attorney?

The message is simple. Do a personal insurance check-up, make sure that you have adequate automobile insurance coverage, and if you do not have adequate coverage, purchase what you need. That is the best way to be prepared for a traffic accident before an accident happens.

As mentioned previously, after an accident happens, call for medical assistance, call the police, and after you have been treated by a medical professional for your injuries, call a Pasadena personal injury attorney – at once – to discuss your legal options and your right to compensation.

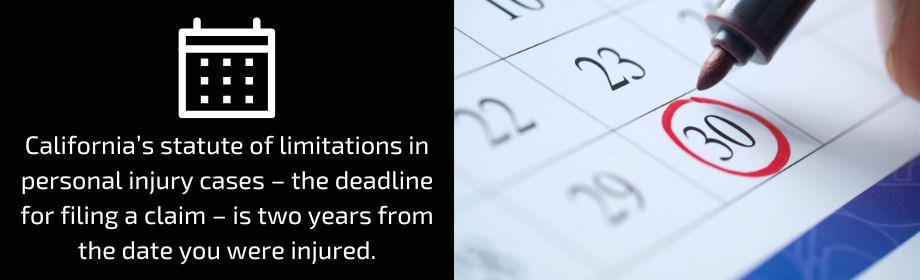

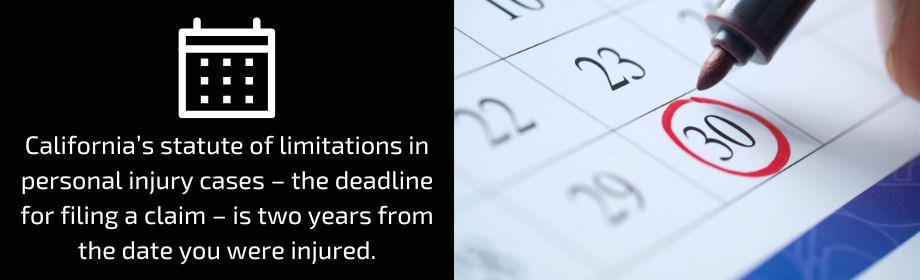

California’s statute of limitations in personal injury cases – the deadline for filing a claim – is two years from the date you were injured. Exceptions are rare, but if you have missed the deadline, a Pasadena car accident lawyer can determine if your case may qualify as an exception.

However, if you’ve been injured recently – or if you are injured in a Southern California traffic accident in the future – contact an accident attorney immediately. It is best if your attorney examines evidence while it’s fresh and speaks to witnesses before their memories fade.

How Are Accident Attorneys Paid?

Your Pasadena personal injury lawyer works on a contingent fee basis, so you pay no attorney’s fee until and unless you recover compensation. Injured victims of negligence are entitled by law to compensation for their medical bills, lost wages, and related damages.

A Pasadena car accident attorney will advise and represent you if you are injured by a negligent driver, but before an accident happens, you can prepare for it by purchasing ample automobile insurance coverage and understanding the details of that coverage.